The content is accurate at the time of publication and is subject to change.

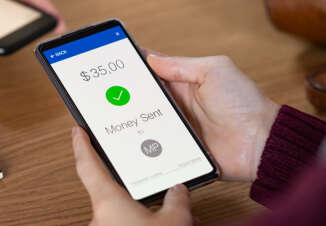

A credit card can be an incredibly useful financial tool to have at your disposal, enabling you to pay for things easily and efficiently. However, credit cards can lead users into big debt trouble if not used responsibly. Figure out how to make your credit cards work for you rather than against you. Paying your credit card bill on time is one of the most important aspects of using credit properly and maintaining a good credit score. This can be tricky given the hustle and bustle of daily life, especially if you use more than one credit card. However, because the majority of banks now provide customers with the opportunity to pay their bills electronically, it is now easier than ever to make sure that you make all of your necessary credit card payments on time every single month.

Two Options

There are two different ways to pay your bills online. You can do it via the bill payment feature built into your credit card issuer’s website, or you can go through the site of whichever bank your checking account is at.

If you opt to make payments using your credit card issuer’s website, the transaction is initiated by your creditor – the entity that is to receive the funds. If you have several different cards all issued by different banks, you will have to log onto the site of each one and navigate through their specific online payment process.

If you prefer to initiate your bill payment from the website of the bank at which your checking account is held, double-check before you begin that online bill payment services are free. These days, most banks extend the service at no charge to their customers with checking accounts. One of the ways that this method is helpful is because your available checking account balance can be easily referenced while you are coordinating payments and you will be able to see everything all in one place – including the payment schedule for your other bills.

If you happen to have a credit card that is issued by the same bank as your checking and savings accounts, you can simply transfer funds from one account to the other to pay your bill.

Helpful Hints

No matter which system you decide to use you will want to be certain that your payments will be submitted to your credit card issuer on time. To do this, you must make sure you have an understanding of the terms of the bill payment system. Pay special attention to how long it will take a payment to be posted to the account and when the payment will be delivered should it be scheduled for a date that falls on a holiday or a weekend.

When scheduling a payment for the first time, enter the necessary information carefully to make certain that you provide the exact billing address and your correct account number. If you are sending payments to different cards, make sure you double-check everything before you confirm any payments to assure yourself that you are sending the proper amount to the proper creditor.

Once you begin to use the Internet to pay your bills electronically, you will find that it is much quicker and more convenient than dropping a check in the mail. You can even set up automatic reoccurring payments that will eliminate the worry of making late payments and help you avoid incurring penalty fees.