The content is accurate at the time of publication and is subject to change.

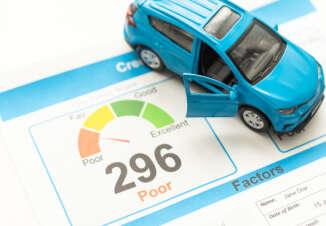

Credit history is an important aspect considered by various banks or any firm who give out loans. Credit history is a record of all the credits raised and the repayments done in the past. It is a reflection of a person's attitude and habits towards repayment of loans. If a person is irregular in repayment of his credit raised it leads the creation of a bad credit history.

Credit points are given out based on ones credit history. The credit score is directly concerned with the ease with which one can raise a loan. Consider an individual who has been regular in the repaying dues on his credit cards. Such a person usually has a high credit score. There are various aspects which influence a credit score. The credit utilization, credit age and the number of credit cards owned. Credit utilization is the difference between the credits raised to the maximum credit limit. The higher the difference the higher the credit score. Credit age is the duration of the credit account. The higher the duration the greater the positive influence it has on the credit score. The number of credit cards owned also has a bearing on the credit score. Greater the number of applications the lesser the credit score. One should always remember that a good credit score has a great deal of advantages and one should try to the best of his ability to maintain a good score.

How to gain a car loan with a bad credit history

One should try every possible way to claw his way out of credit debt and erase his bad credit history. Consider a situation where an individual has a bad credit history but required a car loan. It is doubtful that a car loan or a lease would be granted to one with a bad FCIO score. It is often a frustrating proposal to raise a loan. Finance companies have become stringent in ways of loan appraisal with individuals with subprime histories. But the competition has become so stiff that agencies will do absolutely anything to secure a deal, hence it may even grant a loan to one with a bad credit score but the rates of interest might be high. The following are a list of "should do't" in order ensure you secure a car loan.

• Analyze your credit situation try to figure out where you have gone wrong. Gauge the severity of your debt. A couple of late payment might not have that big an effect on gaining a loan.

• Find agencies who offer the best rates for subprime loans.

• Conduct a through research on all the agencies that specialize in subprime loans. Try to find one that offers the best rates of interest.

• Try to buy a car at the same place you have raised a loan.

• You might also want to try a lease take over. One can consider taking over a car and a car loan from people who want to give it up.