The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

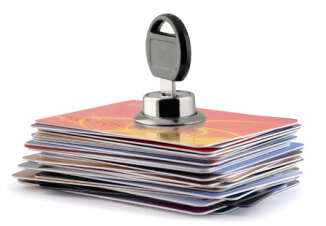

When it comes to credit cards and debit cards, you might want to be careful and ensure that you don`t simply go overboard and use them for anything and everything out there. There are a number of instances when using credit cards has actually gotten people into a lot of trouble. If you don`t want to be in such a dilemma, you might want to learn more about security and protection. With this, you will be able to understand how you can make use of the card without getting into a lot of trouble.

Many people make use of their cards for online shopping. While this is not such a bad thing, you might want to be careful as to where you are making use of your credit card. Hence, it is strongly advised that you don`t simply use the card pretty much anywhere on the internet. Knowing a little more about the website that you are transacting with is important so that you don`t simply end up losing your money. Another solution would be to use third party services like PayPal that can provide significantly more security and protection when you are online.

The next thing that you ought to keep in mind would be to go to only known vendors that you can be sure will not misuse your card for any purpose. Hence, when you shop only at reliable stores, you can be rest assured that you will get the kind of security and protection that you should be getting with your credit cards. This is something that you ought to think seriously about, as people have managed to get into a lot of trouble for buying things with their card from unreliable places.

If you take adequate precautions, you will never have to worry about credit card thefts and other issues that people tend to have for not being careful enough with their information. Hence, this alone should justify the worthiness of having the right kind of security and protection for your credit cards. It is not very hard to learn these things, as you should be able to pick them up along the way. If things are too confusing, perhaps calling in a professional and talking to them can help you understand more. A better option would be to use the internet, as there are quite a lot of tips here as well.