The content is accurate at the time of publication and is subject to change.

5 Tips on How to Improve Bad Credit

Posted on Jan 29, 2018

Updated on Aug 9, 2022

Building credit is very much like losing weight - getting there takes a lot of time and work. Quick solutions may lead you into a trap and leave you worse off than you were before. But if you are worried about your credit situation, that's a start - a lot of Americans aren't even aware that they are in trouble until they have to apply for a mortgage or get a car loan. But if you are determined to make things right, you'll eventually succeed, and the process is not that complicated. If you follow these 5 simple tips, you may get from bad credit to excellent credit in due time.

1. Check Your Credit Report

First things first - you need to know where you are now in terms of your credit score. Start by checking your credit reports and credit scores with the three major credit reporting agencies - TransUnion, Equifax, and Experian. You are entitled to one free credit report from each of these three credit bureaus every year.

When you receive the copies of your credit reports, take note of the things that hurt your credit score such as late payments, delinquencies, debts in collection, accounts you do not recognize and other suspicious records. Be attentive - a credit report is not flawless, it just contains data used to calculate your credit score and it may contain errors. There even may be errors in your personal information. If you see an error, dispute it with credit bureaus and/or your issuing bank.

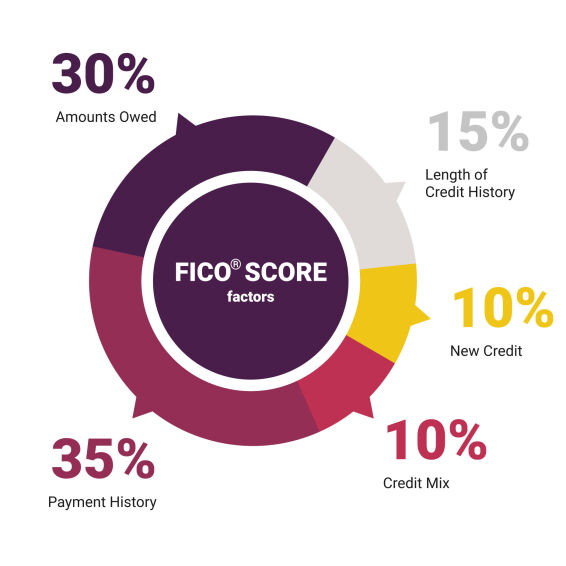

Analyze all negatives that hurt your credit score. Bear in mind that your credit score consists of several things that affect it to a different degree. Some things have more weight than the others. In this pie chart, you can see which things have the most impact.

2. Get Rid of Your Debt

If you've studied the chart thoroughly, you've probably noticed that credit utilization makes up a large portion of your credit score - specifically, 30%. It's almost a third of the whole thing! Credit utilization ratio is the amount of your balance divided by your credit limit. In other words, it's how much you owe. The more debt you have, the less likely you have a good credit score. The perfect utilization ratio should not be over 30%. So, how do you remove debt?

Pay more than the minimum payment. Paying the bare minimum each month lets you shake off the thought of your debt for another month without consuming a lot of resources, so in the short run it may seem like a good way. However, as the APR takes effect, the interest is added to your balance, enlarging it drastically. As a result, your balance grows like a snowball each month, and one day the interest may exceed your initial balance. However, you may easily prevent this if you pay more than the minimum each month and don't let the interest grow.

Pay off your worst credit card first.As we already established, your credit utilization is a proportion. So if you take out the most affecting part of this proportion, it'll change for the better. Try get the credit card with the most debt out of the way first, and your overall debt-to-credit ratio will lower. Besides, a large debt is likely to collect more interest.

3. Get a Secured Credit Card

With a bad credit score, you're likely to face a dilemma: you need a credit card to build credit, but banks won't approve you for a regular credit card with a bad credit score. But there's a way around that. Secured credit cards are meant for building credit and are very easy to use. For a secured card you'll need to pay a security deposit that is usually equal to your line of credit. That is, if you need to pay upfront $200, you'll have a credit limit of $200, but once you close the card, you may get your deposit back. Some secured credit cards can even be upgraded to an unsecured account. Not very attractive? Consider this not a real credit card, but a tool to improve your credit. Below you can see and compare a range of secured credit cards and choose the one for you.

our choice

- Start building credit with just $100 – secure you line with a low, refundable security deposit

- No credit check required – 89% approval rate with zero credit risk to apply!

- Annual fee billed in monthly installments of $2 per month in year 1 and $3 per month thereafter

- Earn up to 10% cash back on everyday purchases

- Affordable payments – minimum payment as low as $10

- Boost your credit score fast—2 out of 3 opensky® cardholders see an average increase of 47 points after 6 months

- Track your progress with free access to your FICO® score in our mobile app

- Build your credit history with reporting to all three major credit bureaus: Experian, Equifax, and TransUnion

- Seamless payments—add your card to Apple Pay, Google Pay, and Samsung Pay

- Fast and easy application—apply in minutes with our mobile-first experience

- Flexible payment options—pick a due date that works for you

- More time to fund—spread your security deposit over 60 days with layaway

- Join 1.6 million+ cardholders who have used opensky® to build better credit!

our choice

our choice

- Is Inflation Impacting Your Credit? A Secured Card Can Help You Rebuild in 20261 — Now offering Up To 10% Cash Back at select merchants with First Latitude!^^

- Now offering cash back rewards on select purchases & payments!^^

- Secure your credit line with your refundable security deposit – choose from $200- $2,000. With the ability to increase up to $5,000 over time!

- Designed to push you forward on your credit building journey with $0 Annual Fee.1

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion.1

- All credit types welcome to apply!

- 1Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

- *See Important Disclosures for complete offer details

- ^^The 10% cash back rate is available only at a limited number of participating merchants. Offer percentages vary by merchant and are subject to change. See First Latitude Rewards Program Terms & Conditions for details.

our choice

our choice

- No annual fee – keep more money in your pocket!

- No credit check required – 89% approval rate with zero credit risk to apply!

- Earn up to 10% cash back on everyday purchases

- Boost your credit score fast—2 out of 3 opensky® cardholders see an average increase of 47 points after 6 months

- Track your progress with free access to your FICO® score in our mobile app

- Build your credit history with reporting to all three major credit bureaus: Experian, Equifax, and TransUnion

- Seamless payments—add your card to Apple Pay, Google Pay, and Samsung Pay

- Start with as little as $300 – Secure your line with a refundable security deposit

- Fast and easy application—apply in minutes with our mobile-first experience

- Flexible payment options—pick a due date that works for you

- More time to fund—spread your security deposit over 60 days with layaway

- Join 1.6 million+ cardholders who have used opensky® to build better credit!

our choice

our choice

- Turn Your Tax Refund into a Credit Building Opportunity in 2026!1 Make Everyday Purchases = Get Rewarded. Make Payments = Get Rewarded.^^

- Now offering Up To 10% Cash Back at select merchants with First Progress! Plus, 1% back when you make payments!^^

- Apply with no impact to your credit!*

- Build your credit history across 3 major credit reporting agencies: Equifax, Experian and TransUnion.1

- All credit types welcome to apply!

- 1Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

- *We may pull a soft inquiry of your credit. Soft inquiries do not impact your credit score.

- ^^The 10% cash back rate is available only at a limited number of participating merchants. Offer percentages vary by merchant and are subject to change. See First Progress Rewards Program Terms & Conditions for details.

- *See Important Disclosures for complete offer details

our choice

our choice

- Earn up to 10% cash back on everyday purchases

- No credit check required – 89% approval rate with zero credit risk to apply!

- Boost your credit score fast—2 out of 3 opensky® cardholders see an average increase of 47 points after 6 months

- Track your progress with free access to your FICO® score in our mobile app

- Build your credit history with reporting to all three major credit bureaus: Experian, Equifax, and TransUnion

- Seamless payments—add your card to Apple Pay, Google Pay, and Samsung Pay

- Start with just $200—secure your credit line with a refundable deposit

- Fast and easy application—apply in minutes with our mobile-first experience

- Flexible payment options—pick a due date that works for you

- More time to fund—spread your security deposit over 60 days with layaway

- Join 1.6 million+ cardholders who have used opensky® to build better credit!

our choice

our choice

- Invest Your Refund in Your Future — Double the Rewards: Earn Up To 10% Cash Back on Purchases & 1% Back on Payments!^^

- Choose our First Latitude Elite Card for a lower annual APR!

- Apply with no impact to your credit!*

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion.1

- No minimum credit score required for approval!

- Secure your credit line with a refundable security deposit - as low as $200 to get started!

- 1Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

- *See Important Disclosures for complete offer details

- *We may pull a soft inquiry of your credit. Soft inquiries do not impact your credit score.

- ^^The 10% cash back rate is available only at a limited number of participating merchants. Offer percentages vary by merchant and are subject to change. See First Latitude Rewards Program Terms & Conditions for details.

our choice

4. Avoid carrying balance

Remember the pie chart? The second thing that affects your credit severely is your payment history. It takes 35% of the whole. Payment history is the information on how you pay all your bills and if you pay them on time. Until you reach at least fair credit, consider all your credit cards just means of showing credit bureaus and credit card issuers that you are a responsible consumer. You need to lead an exemplary financial life without any mistakes.

The most important thing is once you've dealt with the old debt, don't accrue the new one. Never carry a balance on any of your credit cards. Pay off all of the balance by the due date each month. Never be late with your payments, because that way you'll lose a lot of points and bring a late payment fee on yourself. To make things easier for yourself, you may just charge a small amount each month and pay it off at once. Try to carry this style into your future life - even when you improve your credit you'll gain a lot from your habit of not carrying your balance from month to month and escape a lot of problems. And while your credit is far from perfect, this is crucial.

5. Upgrade to an Unsecured Card

As soon as you are free of your debt and have improved your credit score, you can breathe a sigh of relief and move on to better opportunities. If you have a secured card of one of major banks, you may ask for an upgrade to a regular card. Or you can just choose another regular card for bad credit that won't make you pay a deposit. Here are some of our picks:

our choice

- Up to $1,000 Initial Credit Limit

- See if you Pre-Qualify with No Impact to your Credit Score

- Less than perfect credit? We understand. The Surge Mastercard is ideal for people looking to rebuild their credit.

- With responsible card use, you may be able to rebuild or improve your credit

- Unsecured credit card that requires No Security Deposit

- Perfect card for everyday purchases and unexpected expenses

- Monthly reporting to the three major credit bureaus

- Use your card everywhere Mastercard is accepted at millions of locations

- Enjoy peace of mind with Mastercard Zero Liability Protection for unauthorized purchases (subject to Mastercard guidelines)

our choice

our choice

- No Employment or Credit Check

- Bad Credit, No Credit? No Problem!

- Fast and Easy Application

- $750 Limit (Usable only at TheHorizonOutlet.com)

our choice

our choice

- Up to $1,000 Initial Credit Limit

- See if you Pre-Qualify with No Impact to your Credit Score

- Less than perfect credit? We understand. The Reflex Mastercard is ideal for people looking to rebuild their credit.

- With responsible card use, you may be able to rebuild or improve your credit

- Unsecured credit card that requires No Security Deposit

- Perfect card for everyday purchases and unexpected expenses

- Monthly reporting to the three major credit bureaus

- Use your card everywhere Mastercard is accepted at millions of locations

- Enjoy peace of mind with Mastercard Zero Liability Protection for unauthorized purchases (subject to Mastercard guidelines)

our choice