The content is accurate at the time of publication and is subject to change.

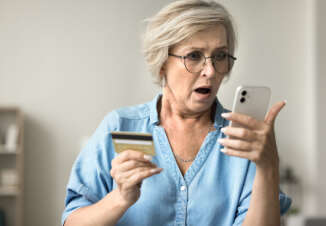

Overspending is a real issue when it comes to using a credit card. Credit cards are hard to maneuver, because they`re resources aren`t finite. Sure, you may have a spending limit, but all of it is money that you don`t own. Overspending can occur when you put everyday purchases on a credit card. Imagine this; you go into a grocery store with the sole intent of purchasing eggs and milk. That shouldn`t cost more than $7 right? Wrong. Next thing you know you`re in the pastry aisle and disbelievingly you`ve racked up $120 in Nutri-Grain Bars and Biscottis. Maybe you don`t overspend at the grocery store, you might overspend when shopping online or when you go out on dates, whatever the case may be. We`ve all been there and done that.

Here are some ways to nix overspending with your credit card.

- Ignore the Options. Paying in the digital age has become so cumbersome. You don`t know which purchase is better suited for a greenback, a debit card, or a credit card. When consumers use their credit card, they are more likely to overspend. This is because the consumer no longer is thinking about how much the item costs, but rather is thinking about how much they want they item. Credit cards allow us to overspend so easily because consumer can still hold on to the cash in their purses and temporarily forget about paying the price.

- Stop Buying in Bulk. In theory, this may seem like the perfect way to budget expenses. But when you buy items in bulk, you tend to consume more. And when you consume more, you end up costing yourself more money. Sure when the math is done, buying 68 of a certain item will lower the price per unit, but in the long run it can end up costing you more money.

- Focus. Pay attention to the things you`re buying. A lot of stores put on sultry music to subconsciously entice shoppers to overspend. Don`t fall victim to this trap by not becoming too comfortable in a retail environment. "Music tends to take the consumers eye off the prize, and allows them to relax in a purchasing setting. If a consumer feels too comfortable, this may lead to bigger purchases and more credit card swipes," said a representative at Credit-Land.com. Other things that can cause you to lose focus are shopping with a friend who is prone to overspend, shopping to waste time, and even dieting. Not eating properly before going shopping can cause consumers to overspend on food and other retail expenses.

- Bargain-Hunting. Ironically, being a super-duper bargain-hunter can actually backfire if you`re trying to minimize your spending. Shopping on sale and clearance racks is ok with moderation. If you are always bunkering through the hangers in the clearance and sale sections, scrounging for the best deal, you might pick up a couple bad deals. When shopping on sale racks, consumers feel that if they don`t buy the item now, they will never see the item again. While this may be true, it`s not a good enough reason to make the purchase. Think twice when shopping on sale racks and make sure you need the item, and you don`t just want it because it won`t be there tomorrow. Don`t spend money foolishly and avoid abundant purchases.

Overspending can cause a lot of financial woes and headache, if you take precautions you can actually reduce your overspending habits and keep your purchasing to a decent level.