The content is accurate at the time of publication and is subject to change.

Christmas Gift Ideas Guide 2025

Posted on Dec 11, 2025

Updated on Dec 11, 2025

The most wonderful time of the year is upon us, so we can say that it's officially time to start looking for the best holiday gifts for those on your Christmas list.

If the holiday spirit has already taken hold and you're rushing to do your holiday shopping, this handy list of versatile gifts is perfect for a wide variety of people and, best of all, they can all be delivered straight to your doorstep.

Best Christmas Gifts Under $50 for Everyone on Your List

The thought of holiday shopping brings both excitement and a touch of panic. Here are some useful, surprising, and fun finds from our experts to help you make your choice without stress. So, whether you need a gift for your closest relatives, a co-worker, or let's be honest, yourself, we hope that a few of these end up in your basket or your personal shopping list.

When choosing a gift, think about what the person likes and the kind of things he or she can really make use of. Whatever you choose, just make sure to put some love and thought into it. They'll appreciate that.

Please note that while we made every effort to confirm that all the gifts in this guide are under $50, prices can change a bit, especially around the holidays.

Xmas present ideas at a glance

Custom Christmas Gifts

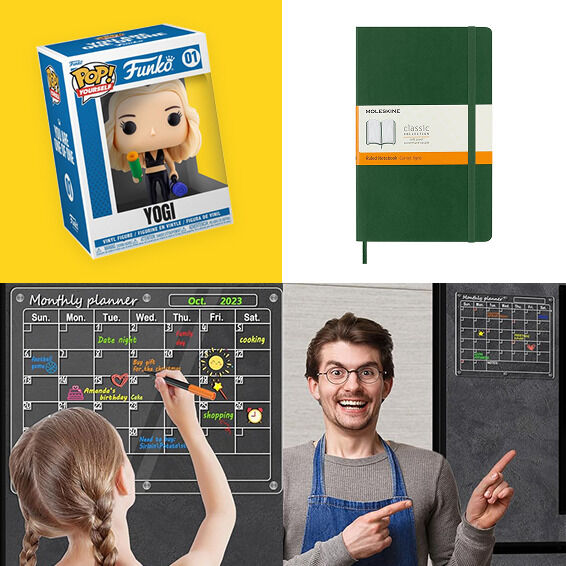

Something custom-made for your recipient can go a long way toward making them feel especially loved. So, we gathered some personalized Xmas gifts you can buy online, including a make-your-own Funko Pop mini figure of your loved one and a Moleskine notebook you can fashion with initials, symbols, and even Christmas wishes.

Who's it for: A fancy co-worker sitting site by site

If you're shopping for someone whose family is constantly juggling schedules and to-do lists, a magnetic calendar could be their much-needed ally. A planner is a versatile tool for keeping modern family life organized and in harmony. When buying, consider models that offer both a monthly and weekly view, dedicated space for notes or groceries, and come with a variety of colored dry-erase markers to color-code different family members or activity types.

Who's it for: Relatives who are always making plans

Affordable Christmas Gifts

Lego fans of all ages will enjoy one of many unique adult building sets from the LEGO Botanicals Collection. Artificial Plant is a thoughtful present perfect for any occasion that never withers.

Who's it for: The new girlfriend

Super easy and small AirTags use Apple's huge network of devices to find everything from lost luggage to lost pets, pinpointing the precise location with impressive accuracy. Those who enjoy traveling, moms with kids, and folks with furry friends won't remain indifferent to such a gift. One item or 4 pack - currently available at a good discount.

Who's it for: The frequent flyer

Such unusual Xmas gifts will undoubtedly delight and please those who are always fixing, tweaking, and repairing things. A multi-bit screwdriver can help with loose hinges, toy batteries, and wobbly door handles, all on the fly. Select the product that has a comfortable-to-hold handle, a good bit selection, and a nice ratcheting action from the vast selection of products available on marketplaces.

Who's it for: For a handyperson

Since nearly three in four Americans consume coffee daily and cannot imagine their life without morning hot brew, the tumbler that gets you through the day feels like a no-brainer.

Who's it for: The caffeinated dad

The Best White Elephant Gifts

If you'd rather not give ridiculous white elephant gifts to whoever you're playing with, you've come to the right place. Whether your budget is $15, $25, or even $50, below are truly good white elephant gift ideas.

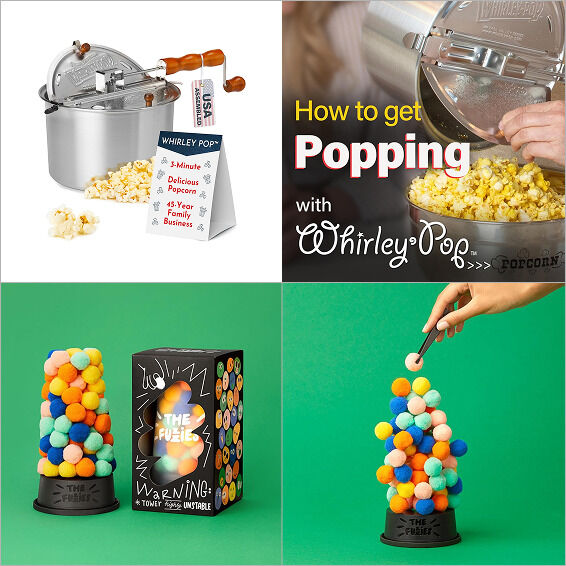

Who's it for: Good for anyone gift

Hilarious games, puzzles, or building blocks are equally fun for adults and kids. No lengthy instructions or fiddly bits - jump straight into a game and enjoy. Jenga-like, the Fuzzies players carefully remove fuzzy balls from the tower using tweezers, place them atop the pile, and hope the whole thing doesn't topple. A 6-year-old will enjoy this game, as will most 40+-year-olds.

Who's that for: Fans of family party games

Where to buy Christmas presents?

Diverse Christmas gift ideas and Xmas lists for every budget are available from well-known retailers like Amazon, Walmart, Target, Best Buy, etc. Almost anything you need can be found in stores or online, including daily essentials, trendy new gadgets, and surely this season's most coveted gifts for family and friends, as well as white elephant gift ideas that make your friends or coworkers fun.

Thus, whether you're a shopper of convenience or just like knowing that your presents will arrive fast, there are numerous good reasons to do your holiday shopping at major chains.

How to pay for your gifts?

During the holiday season, using the right credit card can help you offset expenses and earn rewards on purchases you would make anyway, provided you plan your spending and pay off your balance in full. The best credit card depends on what type of holiday shopping you plan on doing. You can buy gifts with a credit card at most retailers, both online and in physical stores.

It's smart to consider credit cards with rotating bonus categories or with categories of your choice that often include major retailers or online shopping. Such cards allow you to earn more rewards in specific categories this month or this quarter. Just keep in mind that you usually need to activate such categories with higher rewards each month or each quarter. Otherwise, those categories will earn basic rewards offered by the card.

The holidays involve significant spending on groceries and dining out. Using a card that offers accelerated rewards in these categories can quickly build up points or cash back for future use. The Bank of America® Customized Cash Rewards credit card , for instance, offers 6% cash back (3% cash back + 3% first-year cash back bonus) in the category of your choice for the first year, like gas, dining, or online shopping, 2% at grocery stores/wholesale clubs, and 1% on everything else, with a $2,500 quarterly cap on bonus categories.

For all other purchases, a flat-rate cash back card, such as the Citi Double Cash® Card, which earns 2% cash back (1% when you buy, plus 1% as you pay), can ensure you are always earning rewards. Plus, it offers to earn 5% total cash back on hotels, car rentals and attractions booked with Citi Travel.

our choice

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases.

- Redeem cash back for any amount. No annual fee.

- Get a 0% intro APR for 15 months on purchases. Then 17.49% to 26.49% Standard Variable Purchase APR applies, based on credit worthiness.

- Terms and conditions apply.

our choice

our choice

- Click "APPLY ONLINE" to apply now

- Earn unlimited 3% cash back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services, plus 1% on all other purchases with a $39 annual fee

- No rotating categories or limits to how much you can earn, and you can use your cash back for any amount–get gift cards, cover purchases or redeem for cash. Plus, rewards don’t expire for the life of the account

- Be automatically considered for a higher credit line in as little as 6 months

- Help strengthen your credit for the future with responsible card usage

- Enjoy unlimited access to your credit score and tools to help you monitor your credit profile with CreditWise from Capital One

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Earn 8% cash back on Capital One Entertainment purchases with your SavorOne Card and enjoy exclusive access and cardholder perks

- Earn unlimited 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel

- Get access to exclusive reservations at award-winning restaurants and tickets to unforgettable culinary experiences with Capital One Dining

- Capital One SavorOne cardholders can pay with their rewards via PayPal Pay with Rewards and at Amazon.com

- Top rated mobile app

our choice

our choice

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 17.49% - 27.49%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

our choice

our choice

- Apply Now to take advantage of this offer and learn more about product features, terms and conditions.

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

- Earn unlimited 2% cash rewards on purchases.

- 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. 18.49%, 24.49%, or 28.49% variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5.

- $0 annual fee.

- No categories to track or remember and cash rewards don’t expire as long as your account remains open.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Rates & Fees

our choice

our choice

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match. You could turn 35,000 Miles into 70,000 Miles.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee.

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants, and more.

- 0% intro APR for 15 months on purchases. Then 17.49% to 26.49% Standard Variable Purchase APR will apply.

- Terms and conditions apply.

our choice

If you need time to pay off your expenses, such as those incurred during the Christmas season, it's best to consider credit cards with a 0% intro APR offer. If you use a 0% intro APR credit card responsibly, you can pay off those holiday purchases over time typically 6 to 21 months, depending on the card you choose. You must still make at least the minimum monthly payment by the due date every month to avoid late fees, a penalty APR, and even immediate cancellation of your 0% promotional rate.

our choice

- Earn 20,000 bonus Points after spending $1,000 in the first 3 months of account opening.

- 0% Intro APR on balance transfers and purchases for 15 months; after that, the variable APR will be 18.49% - 28.49%, based on your creditworthiness. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Earn 3 ThankYou® Points for each $1 spent in an eligible Self-Select Category of your choice (Fitness Clubs, Select Streaming Services, Live Entertainment, Cosmetic Stores/Barber Shops/Hair Salons, or Pet Supply Stores). Choose your eligible Self-Select Category on Citi Online or by calling customer service. The default Self-Select Category is Select Streaming Services.

- Earn 5 ThankYou® Points for each $1 spent on Hotels, Car Rentals and Attractions booked on Citi Travel® via cititravel.com; earn 3 ThankYou Points for each $1 spent at Supermarkets, on Select Transit purchases, and at Gas & EV Charging Stations.

- Earn 2 ThankYou® Points for each $1 spent at Restaurants; earn 1 ThankYou® Point for each $1 spent on All Other Purchases.

- No Annual Fee

our choice

our choice

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases.

- Redeem cash back for any amount. No annual fee.

- Get a 0% intro APR for 15 months on purchases. Then 17.49% to 26.49% Standard Variable Purchase APR applies, based on credit worthiness.

- Terms and conditions apply.

our choice

our choice

- Apply Now to take advantage of this offer and learn more about product features, terms and conditions.

- 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. 17.49%, 23.99%, or 28.24% variable APR thereafter; balance transfers made within 120 days qualify for the intro rate, BT fee of 5%, min: $5.

- $0 annual fee.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants. It's an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card.

- Rates & Fees

our choice

our choice

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match. You could turn 35,000 Miles into 70,000 Miles.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee.

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants, and more.

- 0% intro APR for 15 months on purchases. Then 17.49% to 26.49% Standard Variable Purchase APR will apply.

- Terms and conditions apply.

our choice

our choice

- Apply Now to take advantage of this offer and learn more about product features, terms and conditions.

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

- Earn unlimited 2% cash rewards on purchases.

- 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. 18.49%, 24.49%, or 28.49% variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5.

- $0 annual fee.

- No categories to track or remember and cash rewards don’t expire as long as your account remains open.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Rates & Fees

our choice

If December crept up on you, don't fret. You still have enough time to find the best gifts for everyone. And if you haven't ventured into earning credit card rewards yet, this holiday season is the perfect time to start.